The Trump administration’s mass deportation efforts may make many undocumented immigrants hesitant to file taxes. Some worry that providing personal information to the Internal Revenue Service (IRS) could be used against them.

Undocumented immigrants pay billions in taxes every year. However, the Trump administration’s efforts to enlist the IRS to increase arrests and deportations of immigrants has spread fear around what had become a commonplace practice to file taxes. The federal government is at risk of losing tax revenue that the United States has long counted on, especially as the IRS is already anticipating a decrease of more than 10% in tax by the April 15 deadline compared to 2024.

A Battle Over Immigrant Tax Data

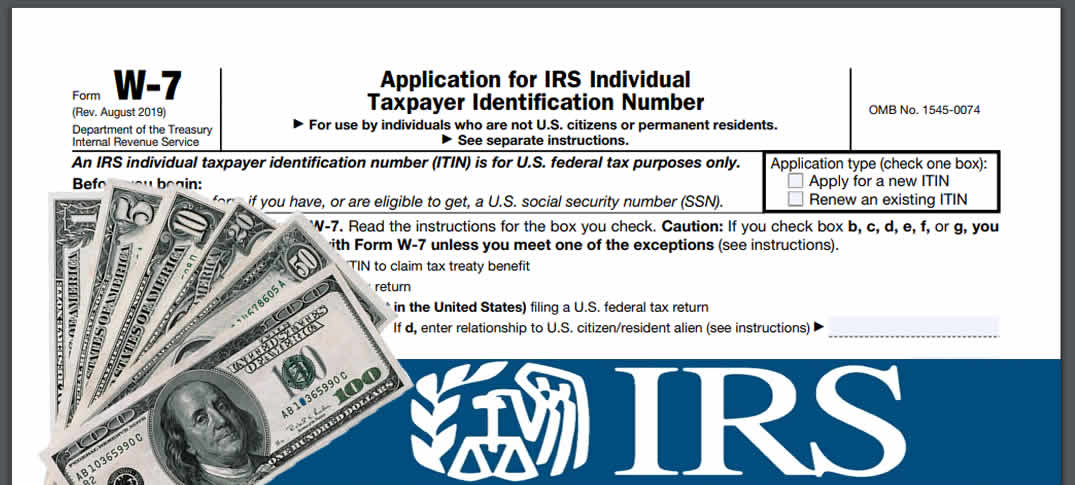

A recent Washington Post investigation revealed that the Department of Homeland Security (DHS) requested the IRS to provide home addresses of 700,000 tax payers suspected of being undocumented. The IRS initially refused, citing tax privacy laws. However, the Washington Post reported on March 22 that the IRS is nearing an agreement to share confidential taxpayer information with DHS. The deal would allow the IRS to cross-reference names and addresses of individuals with final deportation orders submitted by DHS—alarming many tax and immigrant advocates about the misuse of tax data for immigration enforcement.

Representative Debbie Wasserman Schultz and more than 60 other representatives sent a letter demanding the IRS end the abuse of taxpayer’s private data that is targeting immigrant families without criminal histories.

More information https://inmigracionyvisas.com/a6292-Fear-of-filing-taxes-among-undocumented-immigrants.html